Equity, in finance, refers to the ownership of assets once all debts have been paid. It is the net residual interest in the assets of an entity after deducting all liabilities. Equity shows how much someone or something owns a part of a company. This article goes into the details of what equity is, its importance, how it functions, and ways to figure out its value.

Exploring Equity - Types and Forms

Equity is shown in different ways, showing the variety of ownership setups inside companies. Common stock is the most usual kind of equity, offering voting rights and dividends to its holders. Preferred stock does not give voting rights but it does promise to pay dividends first, making it attractive for investors who want regular income. Profits kept in the business, an important element of equity, show earnings that companies have put back into their operations for future growth and expansion efforts. This helps to strengthen the firm's financial stability and flexibility.

While thinking about equity investment, it is important to know the differences between common and preferred stock. Those who own common stock usually have voting rights for corporate decisions. At the same time, holders of preferred stocks are treated better in terms of dividend payments because they often get a fixed dividend before those with common shares do so too. Another aspect to consider is how a company handles its retained earnings and what this reveals about its methods for reinvesting profits along with prospects for long-term growth. Understanding these nuances empowers investors to make informed decisions aligned with their financial objectives.

- Legal Rights: Common stockholders typically possess voting rights, enabling them to influence corporate decisions during shareholder meetings.

- Dividend Preferences: Preferred stockholders receive dividends before common stockholders, ensuring a stable income stream, albeit at the expense of voting privileges.

The Role of Equity in Investment

Equity, which is a key part of investment portfolios, represents ownership in different things. Investors use it to understand how much of a company they own and look at the risks connected to this ownership. Unlike debts that bring assurance with them, investing in equity comes with some unpredictability but also has chances for big gains. Increasing possibilities for investment by using a combination of equities allows investors to take advantage of market changes and lessen the risk they face.

In looking at equity investment, investors check important financial measures to know how companies are performing and stable. The price-to-earnings (P/E) ratio and earnings per share (EPS) give information on valuation and profit, which helps with deciding where to invest money. Knowing the connection between equity prices and market trends helps in making good investment plans matching particular risk interests and financial aims.

- Risk Management: Equity investments carry inherent risks, necessitating prudent risk management strategies to safeguard investment portfolios against market volatility.

- Long-Term Growth: Equities offer the potential for long-term capital appreciation, making them attractive options for investors with a growth-oriented investment horizon.

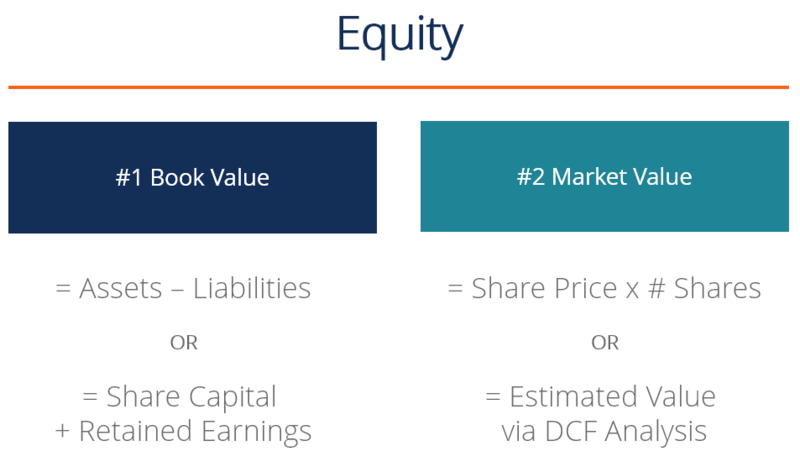

Calculating Equity - Key Metrics and Formulas

Equity calculation uses different measures and equations to evaluate how a company is doing in terms of money matters. The simple equity equation, which is Equity = Assets - Liabilities, shows the remaining value that can be given to shareholders when all debts are paid off. Moreover, financial ratios like debt-to-equity ratio and return on equity (ROE) give an understanding of the leverage and profit-making abilities of a company. These aid investors in assessing chances for investment.

In financial analysis, understanding equity measures together with other performance signs can make investment choices more precise. For example, a good ROE means that equity capital is being used efficiently and the company is making a profit - this shows promise for creating value for shareholders. On the other hand, a high debt-to-equity ratio could point to too much borrowing which brings more danger of finance problems and blocks chances for growth.

- Leverage Analysis: The debt-to-equity ratio assesses the proportion of debt financing relative to equity, influencing a company's financial risk profile and investment attractiveness.

- Profitability Assessment: Return on equity (ROE) measures a company's ability to generate profits from shareholder equity, providing insights into operational efficiency and financial performance.

Strategies for Enhancing Equity

Growing fairness is very important for businesses that want to strengthen their financial base and promote lasting expansion. Putting into place good strategies involves making the most out of money coming in, lessening costs, and getting better at how operations are done. All these things can help increase a company's equity. Careful handling of debt as well as deciding on where capital should be used also play a part in strengthening equity positions, thus improving value for shareholders over time.

In the creation of equity enhancement strategies, businesses need to focus on initiatives that match their growth goals and market dynamics. This can be a result of natural expansion, planned alliances, or joining together with another company through buying and merging processes. In dynamic business settings, promoting an atmosphere where innovation and adaptability are key helps in creating resilience and competitiveness for businesses.

- Capital Efficiency: Efficient capital allocation ensures optimal utilization of resources, fostering organic growth and enhancing equity value.

- Market Positioning: Strategic market positioning and branding initiatives bolster brand equity, enhancing customer loyalty and market competitiveness.

The Significance of Equity in Financial Markets

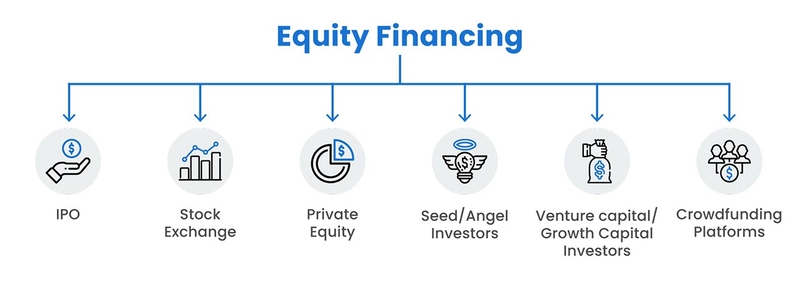

In the context of investing, equity markets are constantly evolving places where people can purchase and sell ownership stakes in companies that are listed on public exchanges. These markets have a vital function in forming capital as they allow businesses to gather funds for growth, advancement, and tactical activities. Equity investments give investors chances to involve themselves in the potential growth of companies from various sectors and industries. It offers them paths for making wealth and spreading risk through a mixture of investment alternatives.

To make sense of the intricacies of modern finance, investors need to comprehend how equity markets work. Things like supply and demand forces, investor mood, and economic signals can affect equity prices and results from investments. Also, events such as corporate earnings reports, rule changes by regulators, or happenings in geopolitics may impact market instability along with investment performance - highlighting why careful study and strategies for managing risk are so important in this area.

- Volatility Management: Equities are subject to market volatility, necessitating risk mitigation strategies such as portfolio diversification and asset allocation rebalancing.

- Market Liquidity: Liquidity, or the ease of buying and selling equities, varies across markets and securities, impacting transaction costs and investment flexibility.

Conclusion

Equity is a word that comes from the world of finance, and it means having ownership or investment in something. This term has deep meaning in many parts of business and investment. It guides how choices are made and affects the results shown on financial reports. When people understand what equity entails, they can use this knowledge to find chances for creating wealth and making steady progress. In this article, we have seen a broad picture of equity. It has given us an understanding of what it means, how it works, and its uses in the finance sector.